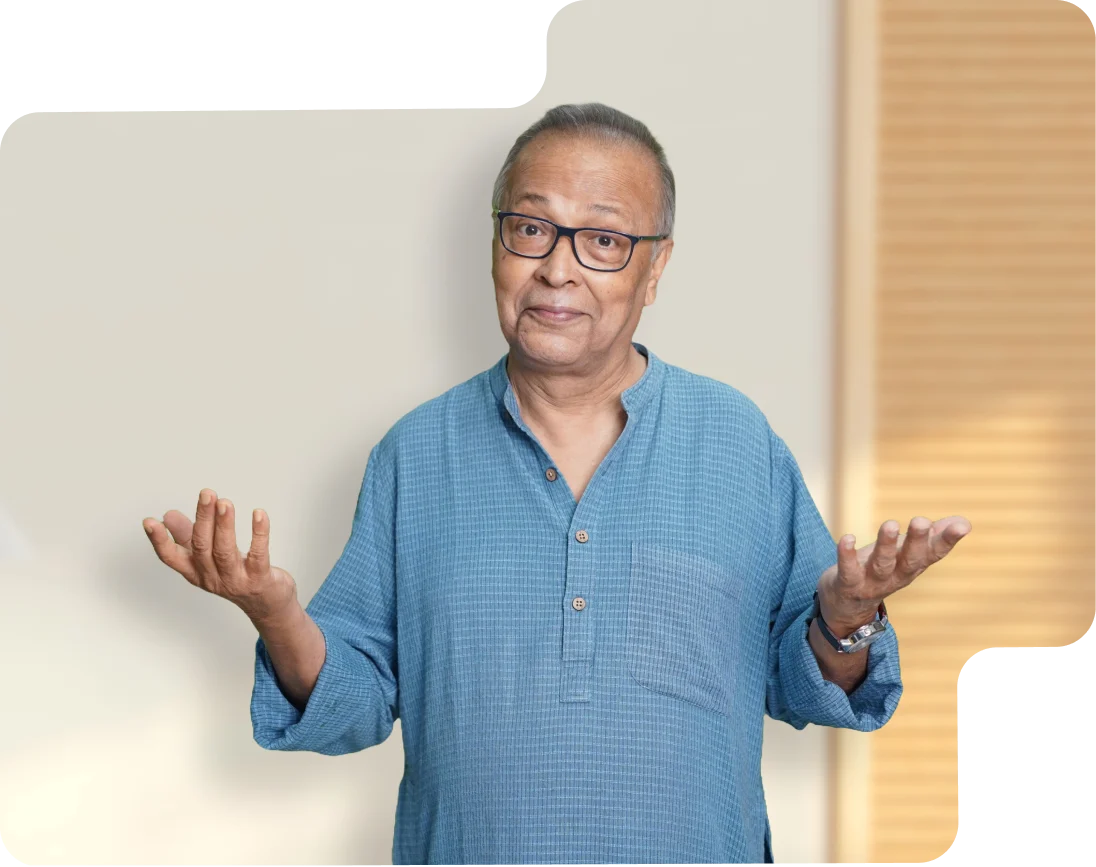

We are proud to share the remarkable journey of renowned MD Dr.

Kulshekhar Bhattacharya, who fell into the trap of insurance brokers

and agents who falsely promised him dividend benefits including

flat, car, tour and bonus. He has lost a total of Rs 80 lakh and out of

this Rs 55 lakh has already been successfully recovered by us.

Dr. Kulashekhar Bhattacharya

(MD, MBBS, Pathology, A.G.M.C - Tripura | PS: Agartala)

Tarun Kr. Sanpui, a 50-year-old primary school teacher, was misled

by an insurance agent and lost Rs 20 lakh in the name of loans - a

devastating financial blow. Thanks to the dedicated support of our AI

Recovery team, he was able to recover Rs 10 lakh in just 3 months.

Mr. Tarun Kumar Sapui

(School Teacher - South 24 Parganas | PS: Mandirbazar)

After retiring from Netaji Nagar Day College in 2010, Prof. Prabir

Basu Choudhury was duped by a fake insurance agent who falsely

promised to recover his old policy that had expired. He had lost Rs 12

lakh. Feeling helpless, he and his wife turned to AI Recovery and

High Value Services, filled with fear and uncertainty about how to

recover their money. To their great relief, the entire amount was

recovered in just 15 days!

Mr. Prabir Basu Chowdhury

(Retired Professor, Netaji Nagar Day College - Kolkata. PS: Santoshpur)

We are proud to share the extraordinary journey of Dr. Anirban

Gupta, a dedicated homeopathic doctor, who successfully recovered

Rs. 6.50 lakhs - the amount he had lost due to fraud and mis-selling

of insurance. Thanks to AI recovery and high-value services, justice

was served and his hard-earned money was duly recovered.

Dr. Anirban Gupta

(Homeopathic Doctor - Kolkata | PS: Barasat)

One of our valued customers, Pannalal Karmokar, a resident of

Darjeeling, West Bengal, was cheated by some fraudsters and agents

of the insurance company. 90% of his lost hope and money has been

recovered by our team.

Mr. Pannalal Karmakar

(Tea State Manager - Darjeeling | PS: Darjeeling Sadar)

Shrikant Chaudhary, a resident of Bankura in West Bengal, was

wrongly sold 11 insurance policies of four insurance companies. He

was sold an insurance policy of Rs 6 lakh. When she finds out she has

been cheated, she feels hopeless and doesn't know what to do. Then,

through a friend, he learned about the All-Insurance Recovery. He

came to us and we listened to him and helped him recover his hard

earned money.

Mr. Srikanta Chowdhury

(Businessman - Bankura | PS: Bankura Sadar)

This is an example of how one of our customers mis-sold a Rs 11 lakh

insurance policy. In which, A-I Recovery and High Value Services

extended their warm helping hand and recovered his hard-earned

money.

Md. Didarbox Molla

(Court Clerk - Basirhat | PS: Fulbari)

Six years ago Gaura Chandra was in a small dasikarmashala

(benedokan) of Janar. He lost Rs 20 lakh after being misled by an

insurance agent. As a result, his family became deeply indebted and

depressed. With the help of our AI Recovery and High Value Service

team, he has recovered Rs. 4.50 lakh within a few months and the

remaining amount is being processed through the customer forum.

Gour Chandra Jana is extremely grateful for our support, which has

restored his hopes and dreams.

Mr. Gour Chandra Jana

(Businessman - Kakdwip | PS: Kakdwip)

In the name of insurance services, the fraudsters embezzled more

than Rs 9 lakh from Shri Ghosh by promising retirement benefits and

refund schemes. His wife Sapna Ghosh (a cancer patient) and

daughter were also victims of the fraud. Frustrated, the Ghosh family

sought help from AI Recovery and High-Value Services as a last

resort. With our skill and dedication, it is possible to recover the

entire money in 3-4 months of effort. Today, not only the money, but

also their peace of mind has returned. That's our success.

Mr. Tapas Ghosh

(A retired personal - Siliguri | PS: Siliguri)